Three cities go backwards as national property price momentum eases

Three cities are booming and three are going backwards as overall momentum in the property market eases and inflation presents as a wildcard.

A shortage of properties on the market is fuelling the fast-track capitals, while real estate prices in three cities trapped in the slow land have gone backwards.

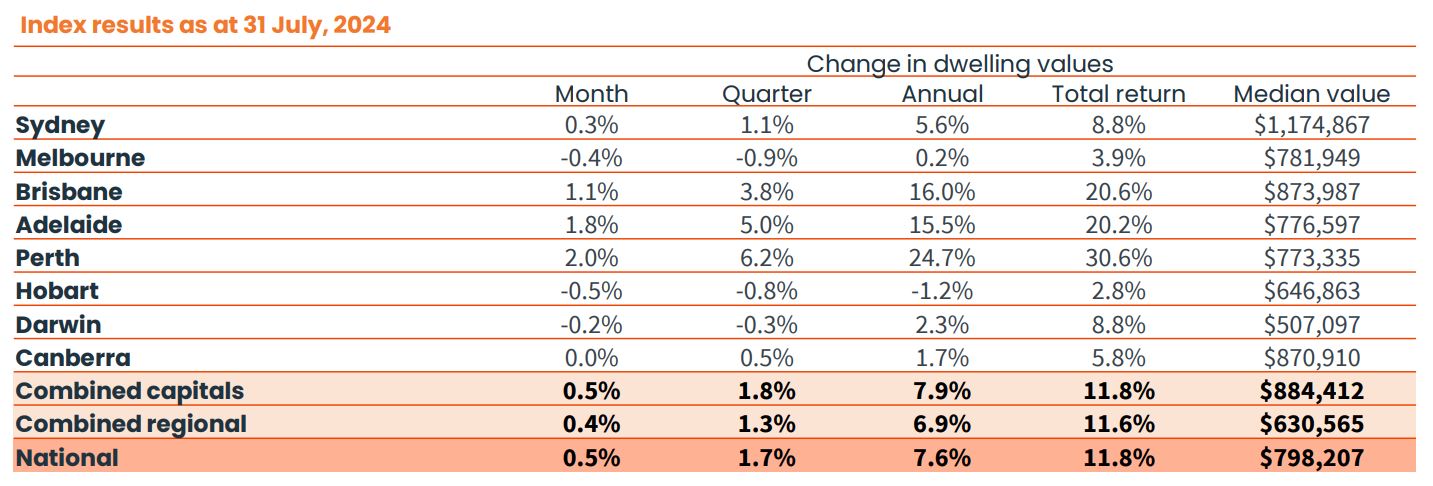

Melbourne, Hobart and Darwin are back in the red, slipping 0.4, 0.5 and 0.2 per cent respectively, according to the July Home Value Index (HVI) published by CoreLogic.

This was in stark contrast to three usual suspects, Perth, Adelaide and Brisbane. These red hot property markets continued their double digit annual trajectory with monthly gains of 2.0, 1.8 and 1.1 per cent respectively.

These mid-sized capitals are continuing to buck the overall national slowing trend.

Quarterly pace of growth in Perth is tracking at 6.2 per cent, while growth in Adelaide accelerated to 5.0 per cent, the fastest rolling quarterly pace of growth since May 2022. Brisbane values rose at a quarterly pace of 3.8 per cent, though this is down from a 4.7 per cent increase seen this time last year.

National home values rose 0.5 per cent in July, the 18th consecutive monthly increase in home values nationally – a figure on par with the 0.5 per cent increase recorded in June. Following a 7.5 per cent decline recorded between May 22 and Jan 23, the national HVI has gained 13.5 per cent and values have consistently pushed to new record highs since November last year.

Tim Lawless, Research Director, CoreLogic’s, said available supply is a key factor explaining the diverse outcomes in housing growth trends.

“The number of homes for sale in Brisbane, Adelaide and Perth is more than 30 per cent below average for this time of the year, while weaker markets like Melbourne and Hobart are recording advertised supply well above average levels,” Mr Lawless noted.

Perth property prices are now a remarkable 24.7 per above a year ago, with its median dwelling price of $773,335 on track to soon overtake Adelaide’s $776,597. Both cities could also soon join Brisbane in overtaking Melbourne’s $781,949.

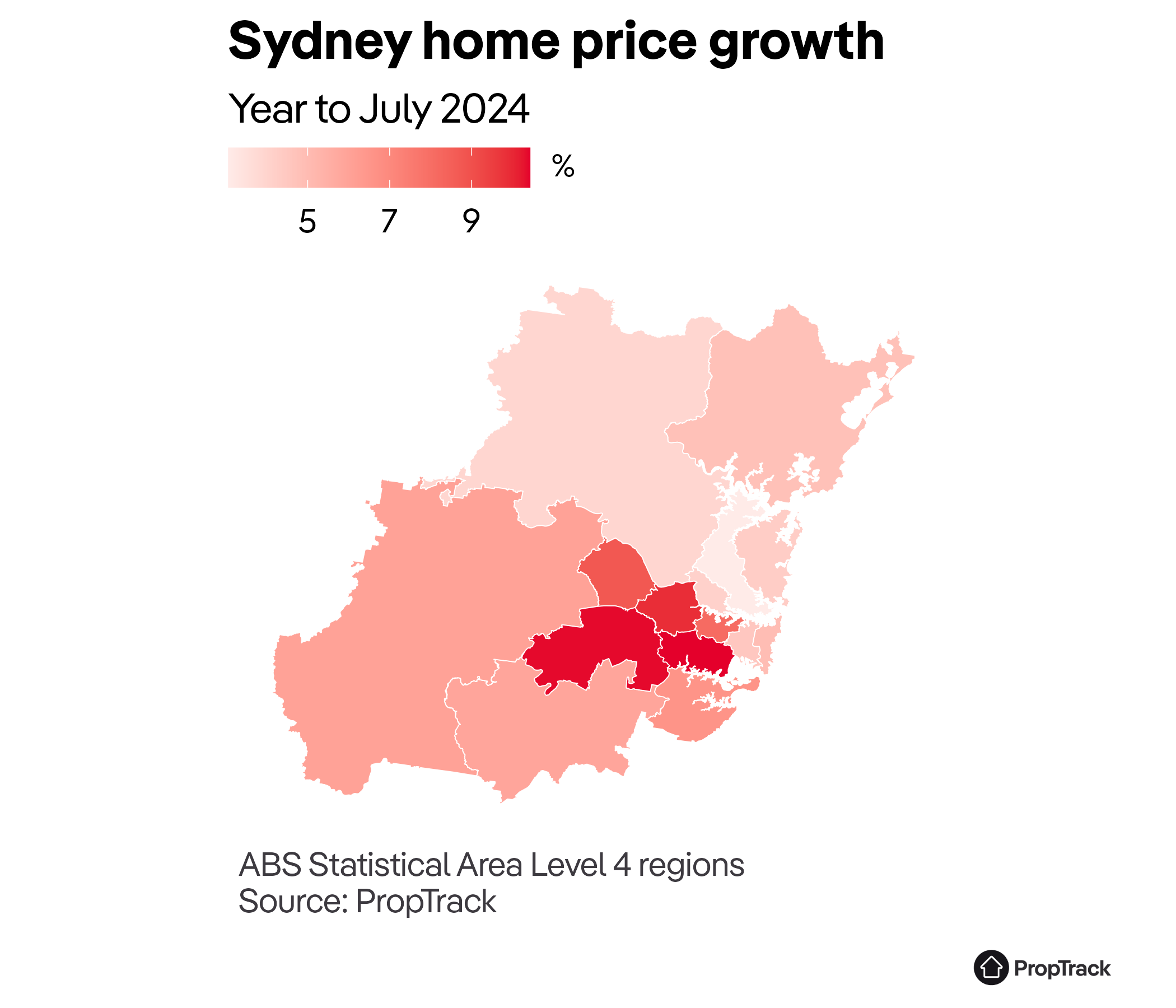

Monthly property price data also released on Thursday (1 August) by PropTrack, showed Sydney’s unspectacular but steady price ascent had extended record prices there. Prices are now up 6.1 per cent over the past year and 4.8 per cent higher than the peak recorded during the pandemic.

Paul Ryan, PropTrack’s Senior Economist, said national home price growth persisted in July, albeit at a slower pace given the seasonally quieter time of the year.

“Strong housing demand pushed prices higher, despite more homes being listed in what is a higher interest rate environment.

Slow construction activity, above-average income growth and July’s tax cuts are clearly contributing.

“Further home price growth is expected over the coming months as the market moves into the traditionally busier spring selling season, however, the pace of price growth is likely to remain modest as uncertainty about the path of interest rates and affordability challenges constrain buyers’ budgets.”

Interest rate implications

Housing is now the biggest contributor to annual inflation, a situation that could prove self-perpetuating if the Reserve Bank raised interest rates in response to this higher inflation.

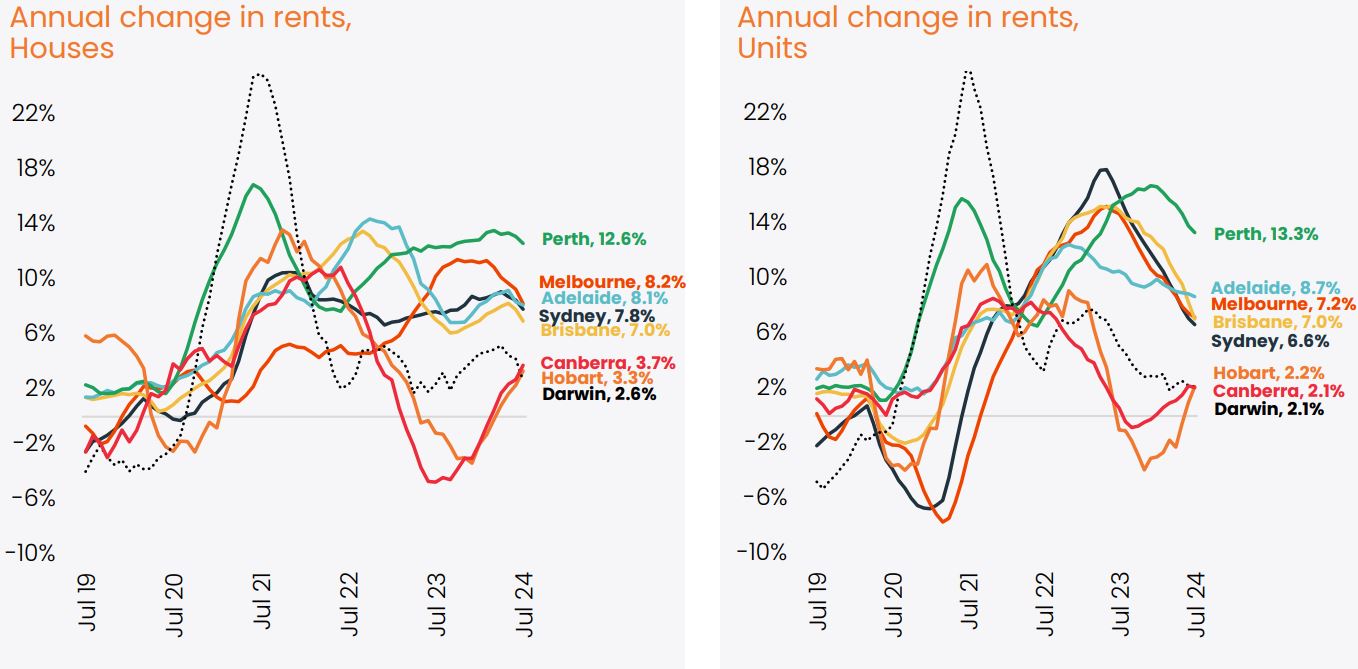

The pace of rental growth is easing but still rising at a time when renters are wrestling with myriad cost of living issues.

CoreLogic’s hedonic rental index was only 0.1 per cent higher in July, the smallest monthly rise since August 2020.

A clear slowdown in the pace of rental growth across the unit sector has been the main drag on rental growth, especially in Sydney where the annual change in unit rents has dropped from 17.9 per cent in May last year to 6.6 per cent.

Melbourne and Brisbane unit rents have also lost more than 8 percentage points in the annual growth rate. The slowdown in unit sector rental growth is off a high base.

Despite the slower rate of annual growth, Sydney unit rents still rose by 6.6 per cent over the past 12 months, which is more than double the pre-Covid decade average (2.7 per cent annual growth) and well above the nation’s inflation rate, which on Wednesday (30 July) accelerated to 3.8 per cent. Housing inflation rose even higher, to 5.5 per cent.

Real Estate Buyers Agents Association of Australia (REBAA) President Melinda Jennison said the slowdown in property price growth this past month could be at least partly attributed to the interest rate situation.

“Across the country, the more affordable end of the market continues to outperform the higher-priced properties in terms of price growth, aligning with the trend of stronger monthly growth in the unit market compared to the house market,” Ms Jennison said.

“Nationally, property values are still on the rise month-on-month, though the rate of growth is easing.

“This slowdown may be attributed to persistent inflation, delays in anticipated interest rate cuts and concerns that rates may stay higher for longer.

“Additionally, cost-of-living pressures continue to tighten household budgets.”

Homeloanexperts.com.au CEO Alan Hemmings has predicted the RBA will hold the cash rate target steady at 4.35 per cent next week. This was after CPI data showed inflation was up 1 per cent for the quarter to June and 3.8 per cent for the year to June.

“The RBA board is in a difficult position; the largest driver of inflation was housing costs, raising rates would only increase these costs,” Mr Hemmings said.

“When you look at trimmed mean inflation (which removes the bottom and top 15 costs) inflation actually came down to 3.9 per cent, from 4 per cent and most economists were forecasting that if this was the outcome it would allow the RBA to hold.”

Hope for building sector

One area in which inflation is easing is with building costs.

Beyond the number of homes available to purchase, the supply of newly built homes remains insufficient relative to population growth.

A further 6.5 per cent drop in dwelling approvals through June highlights the challenges faced by the residential construction sector.

Profit margins have been compressed, skilled trades are scarce and holding costs remain high.

“On the positive side, we are now seeing residential construction costs rising at the slowest annual pace in 22 years,” Mr Lawless said.

“Although the cost to build isn’t reducing, the slower pace of growth should provide builders some confidence that project costs won’t blow out.

“Additionally, with established housing values rising almost three and half times faster than construction costs, profit margins should gradually repair.”