Tax cuts increase borrowing power but could fuel inflation, property prices

Home buyers will be contemplating more expensive property purchases with their increased borrowing power, while mortgagees will be hoping to bolster their loan repayments, with the Stage 3 tax cuts coming into effect.

As the new financial year begins, millions of Australians will be feeling a sense of mild relief that they have received a cut to their tax rate.

But as well as having an average of $1,888 extra on their annual income statement, for many Australians it will be welcomed for another reason.

For home buyers, the Federal Government’s Stage 3 tax cuts are set to receive a boost in borrowing power. Those already on the property ladder could slice years off their mortgage.

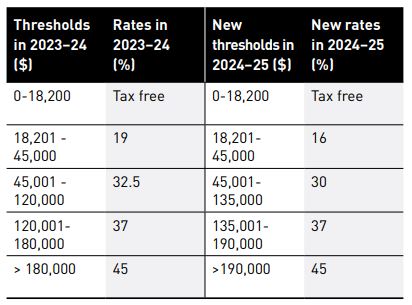

The tax cuts reduce the 32.5 per cent tax bracket down to 30 per cent and increase the 37 per cent threshold from $120,000 to $135,000.

Additionally, the 45 per cent threshold is being increased from $180,000 to $190,000, and the lowest tax bracket drops to 16 per cent, from the current rate of 19 per cent, for those earning between $18,000 to $45,000.

Individuals earning above $120,000 will see the most substantial tax cuts due to the flattening of the tax brackets and the increase in the threshold for the highest tax rate.

The long political gestation of the tax reform culminated in the delivery of the cuts from Monday (1 July), after the Albanese government adjusted the original ruling Liberal Party’s measures to pare back benefits from the wealthy and bolster savings for low income earners.

Concerns have swirled around the tax cuts fuelling inflation that has stubbornly refused to fall below the preferred limit of 3 per cent.

Sally Tindall, Research Director, RateCity.com.au, said borrowers should start preparing their budgets for the possibility of not just one, but potentially two more rate hikes before the year’s end.

The tax cuts could both offset and contribute to this likelihood.

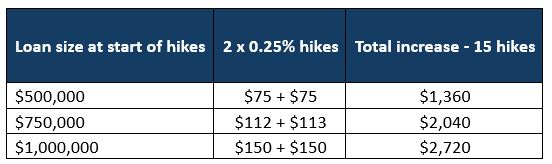

Ms Tindall said that for an owner-occupier with $500,000 debt at the start of the hikes and 25 years remaining, two more rate hikes would add another $150 onto their monthly mortgage repayments.

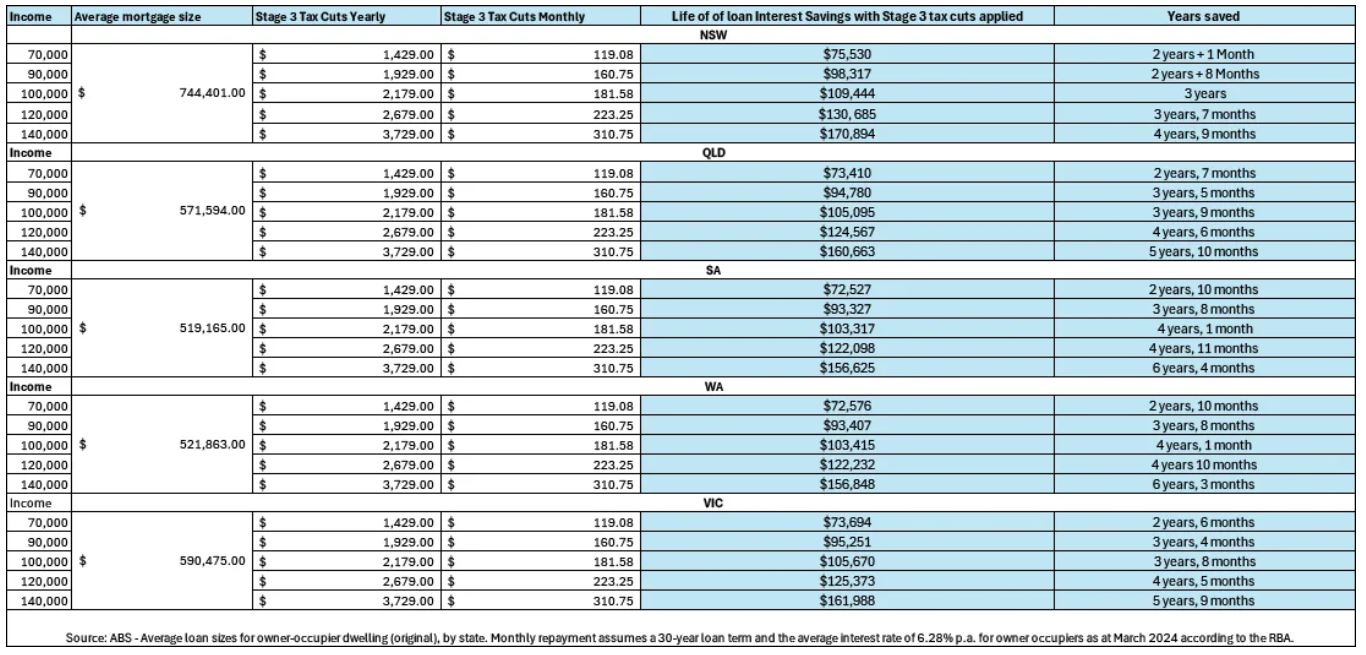

At existing interest rates, the cuts would still mean, for an average mortgage repayment of $3,681 a month on a $625,791 average loan, the tax cut could potentially wipe out one monthly mortgage repayment per year.

That is based on a dual income family with a combined household income of one person earning $100,000 and getting a $2,179 annual tax and another person earning $80,000 and getting a $1,679 tax cut.

The combined value of the tax cut in this case is $3,858.

As of 1 July, the national minimum wage was also increased by 3.75 per cent. The new rate will be $24.10 per hour.

Greater borrowing power

Helen Avis, Director of Finance, Specialist Mortgage, said the tax regime adjustment means many Australians will see an increase in their disposable income.

“Higher disposable income directly translates to enhanced borrowing capacity for prospective home owners and investors,” she said.

“These savings can significantly impact an individual’s serviceability for a mortgage, as lenders assess borrowing capacity based on net income.

“More take-home pay means borrowers can afford larger loans, leading to an uptick in borrowing power.”

To illustrate, Ms Avis noted that a single borrower earning $100,000 annually could see their borrowing capacity increase by approximately $50,000.

“This substantial boost could be the difference between securing a dream home and settling for a less desirable option,” she said.

Steve Douglas, Chairman, Australasian Taxation Services, said that the broader economic implications could amount to increased activity in the property market.

“The Stage 3 tax cuts are poised to stimulate the housing market by increasing demand through having 13.6 million Australians having some extra real income.”

“When individuals have more disposable income, they are more likely to invest in property, whether it be their first home, an upgrade, or an investment property.”

Mr Douglas highlighted the potential ripple effects on property prices.

“With increased borrowing capacity, we may see heightened competition in the housing market, which could drive property prices up.

“While this can be beneficial for current home owners looking to sell, it may pose challenges for new buyers trying to enter the market.”

Mortgage aggregator Aussie published on its website two examples of how the new tax changes could bolster borrowing power.

One such scenario indicated that single Australians with no dependents earning $120,000 per year in the financial year just concluded, who could borrow a maximum $615,135, will increase their borrowing capacity in Financial Year 2025 by $27,062 on a mortgage, based on a 6.28 per cent interest rate, to $642,197.

Additionally, a married couple with two dependents earning a combined taxable income of $280,000 will increase their borrowing capacity by $75,346 on a mortgage with a 6.28 per cent interest rate in FY25, which is a 5.64 per cent increase on their previous maximum borrowing amount of $1,334,871.

Additional reporting by Sasha Bennett