Perth's million dollar property club explodes

Perth's million dollar property club has expanded in spectacular fashion, with a record number of suburbs moving into this rarefied zone and surging investor loans in Western Australia highlighting the rush for that state's houses.

Perth’s meteoric price rises have made asset millionaires of thousands of Perth property owners, with an unprecedented 30 suburbs joining the city’s million dollar club in the past year.

Highlighting the relatively sudden upwards jolt the market has experienced in the Western Australian capital, only two new suburbs joined the list in 2022-2023.

There are more than 350 suburbs in Perth, and 87 of them can now lay claim to a median house sale price of $1 million.

REIWA President Joe White on Thursday (15 August) said the record number of new entrants reflected Perth’s extremely strong price growth over the past 12 months.

“Under normal market conditions you can expect to see a few new suburbs join the million-club each year as their prices rise due to improved amenity or infrastructure, growing popularity for certain lifestyle features, or as a flow-on effect from price growth in neighbouring suburbs,” he said.

“However, this financial year house price growth in Perth has accelerated and the median house price has increased 18.8 per cent.

“The high demand for established homes, fuelled by population growth and limited new housing supply, has seen strong price growth across the metropolitan area, with nearly a quarter of the suburbs in the million-dollar club recording growth greater than the overall Perth market.”

New $1 million suburbs

| SUBURB | ANNUAL MEDIAN HOUSE PRICE |

|---|---|

| Oakford | $1,490,000 |

| Shelley | $1,260,000 |

| Highgate | $1,252,500 |

| Kallaroo | $1,221,000 |

| Alfred Cove | $1,215,000 |

| White Gum Valley | $1,182,500 |

| Karawara | $1,155,000 |

| Melville | $1,150,000 |

| Coogee | $1,135,000 |

| Perth | $1,130,000 |

| Stirling | $1,125,000 |

| Mullaloo | $1,120,000 |

| Inglewood | $1,117,500 |

| Manning | $1,115,000 |

| Myaree | $1,105,000 |

| Carmel | $1,100,000 |

| Murdoch | $1,100,000 |

| West Swan | $1,100,000 |

| Bull Creek | $1,095,000 |

| Ocean Reef | $1,090,000 |

| Cardup | $1,067,500 |

| Scarborough | $1,067,500 |

| Duncraig | $1,060,000 |

| Darlington | $1,050,000 |

| Bedfordale | $1,025,000 |

| Gooseberry Hill | $1,020,000 |

| Leeming | $1,020,000 |

| Willetton | $1,020,000 |

| West Perth | $1,015,000 |

| Ascot | $1,000,000 |

Source: REIWA. Filtered for suburbs with median house sale prices greater than $1,000,000 for the 12 months to June 2024.

Leading the charge among the chosen 87 was Karawara, which saw a 43.5 per cent in its median house sale price to $1,155,000.

Mr White said Karawara’s appeal lay in its proximity to the Canning River, city and Curtin University, which appealed to a wide range of buyers.

“The suburb is undergoing a transformation, with upgrades to Waterford Plaza offering residents two supermarkets and a range of new eateries,” he said.

“Properties have also undergone renovation and revitalisation in recent years, helping boost prices in the area.”

Peppermint Grove retained its place at the top of the million-dollar list with a median house sale price of $3,700,000 in the 12 months to June, followed by Cottesloe and Dalkeith at $3,500,000.

Plunging listings are separating Perth’s turbo-charged property market.

While listings are increasing in most of the country, Perth’s supply of homes for sale is tanking.

Canberra (+33.7 per cent), Melbourne (+21.7 per cent) and Sydney (+17.4 per cent) have seen the largest increase in total listings over the past year among capital cities, while Perth (-20.2 per cent), Adelaide (-6.9 per cent) and Darwin (-2.4 per cent) were the only capitals to record a fall.

Perth’s lack of stock is in marked contrast to Melbourne, where property prices are stagnant, and Sydney, which is growing modestly. Both of those more populous cities have seen new listings month by month for a year.

Nationally, capital cities have seen a 14.4 per cent rise in new listings year-on-year compared to a 7.9 per cent rise in regional markets, according to PropTrack.

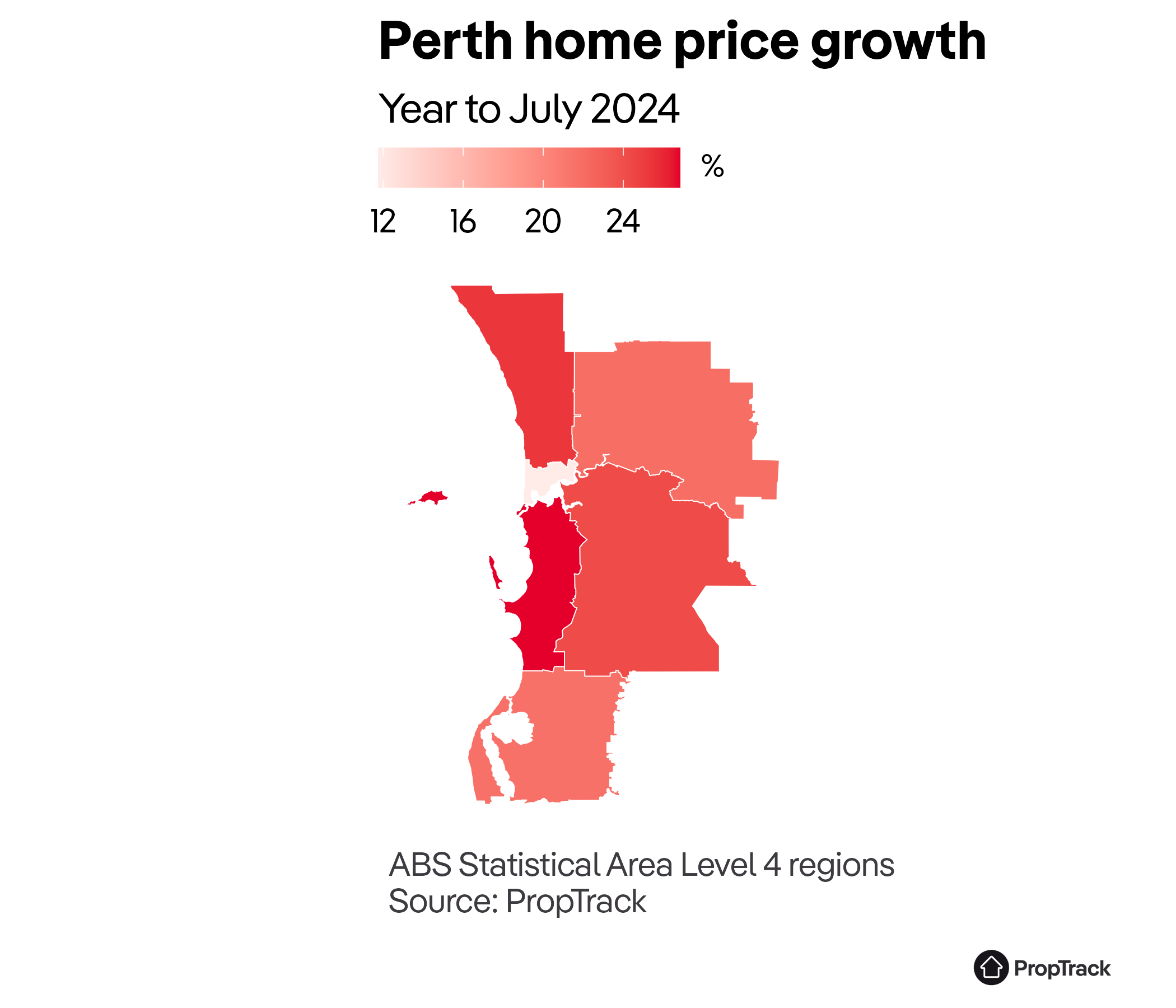

Perth’s pace of property price growth is streaks ahead of the rest of the country, with 22.77 per cent year-on-year growth in July, while Adelaide was a distant second at 14.81 per cent, and Brisbane took bronze with 13.93 per cent growth.

Perth continues to experience faster growth in the most affordable suburbs.

List dominated by suburbs with wealthier neighbours

Julie Kelley, Global Sales and Marketing Manager for aussieproperty.com, highlighted that the newly listed suburbs in the million-dollar club from inner-city and middle-ring areas are all “bridesmaid suburbs.” These neighbourhoods, adjacent to existing million-dollar suburbs, are gaining attention due to their appealing characteristics, including established infrastructure, proximity to the CBD and public transport, access to amenities, reputable school zones, and closeness to the ocean or river.

“Landed properties with potential for future renovation or subdivision in Willetton, Perth, and White Gum Valley have entered the million-dollar club,” Ms Kelley explained.

“This trend is largely driven by increased demand as population growth intensifies pressure on the limited supply coupled with relaxed zoning regulations.”

Ms Kelley further noted that in White Gum Valley, approximately half of the sales over the past six months have been for properties with development potential on 800sqm or larger blocks. The remaining sales have been for move-in ready family homes, offering a more affordable alternative to neighbouring areas such as East Fremantle, South Fremantle and Palmyra.”

South of the Swan River, suburbs new to the million-dollar list include Shelley, Alfred Cove, Coogee, Manning, and Melville. Their inclusion means that all waterfront suburbs from Shelley through to Coogee now have a median home price tag above $1 million, which Ms Kelley said wasn’t surprising.

“These southern middle-ring suburbs are also ‘bridesmaids,’ where the presence of high-performing school zones plays a significant role in driving up market prices.

“Families are fiercely competing to secure property in these highly sought-after areas, including Bull Creek, Willetton and Leeming,” Ms Kelley said.

She also pointed out that the outer suburbs, such as Oakford and Gooseberry Hill, which have recently joined the million-dollar club, are primarily being purchased by families.

“These areas offer beautiful, expansive homes on large blocks further from the city.

“While they may lack the same level of local amenities, these properties compensate with their grandeur and size,” she added.

Could the market have reached a peak?

Investors are also jumping on board the property juggernaut in the west.

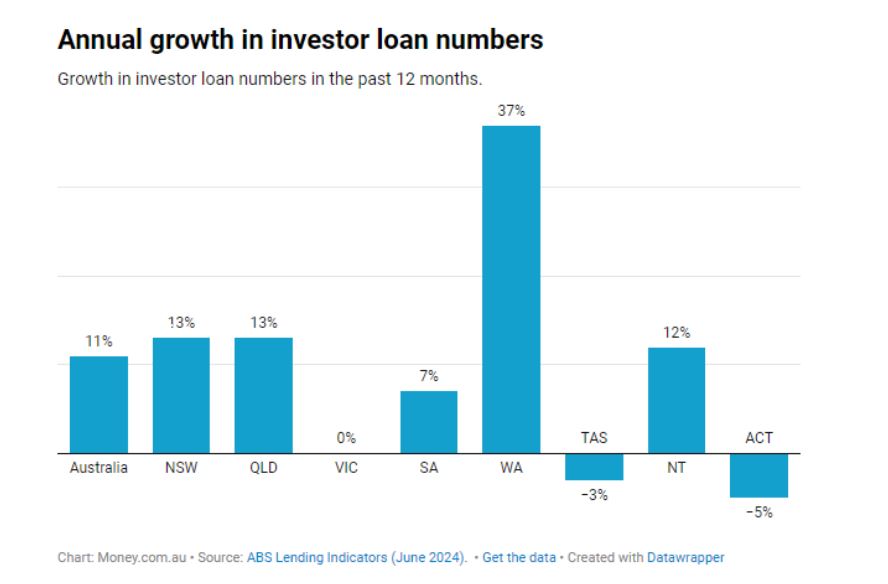

Data from Money.com.au reveals that investor loans in Western Australia have surged 37 per cent over the past year—over three times the national average increase of 11 per cent.

The investor boom in WA has been fuelled by the influx of interstate investors snapping up property in Perth, where house prices have increased by 23.8 per cent year-on-year

Peter Drennan, Money.com.au’s Research and Data Expert, said Australia is seeing a boom in investor activity — investor loans now account for 38 per cent of new loans issued. That’s up from just 22 per cent seen at the lows of 2020.

“WA is the golden goose, with the number of investor loans in the state rising by 37 per cent annually.

“This investor interest is powered by five key factors: the state’s growing population, increasing property values, strong rental demand, low vacancy rates, and the resources boom in the region,” he said.

The company’s Home Loans Expert, Mansour Soltani, warned that the housing market in WA may have reached its peak, with a lack of supply now driving investors to Victoria and South Australia, where supply is more readily available and property prices remain relatively attractive compared to other states.

“WA has seen solid growth in investor lending in the last five years, but property prices in the state are now higher than investors may be willing to pay.

“It’s an inflated market and the bubble will eventually burst,” he said.