Bombshell ATO report reveals foreign property buying soars

Foreign property buyer numbers have taken off, with international real estate investors shaking off their post-Covid blues and turning their attention to Australia.

Foreign buyers are returning to the Australian property in large numbers, with total transactions soaring by 27 per cent over the previous financial year.

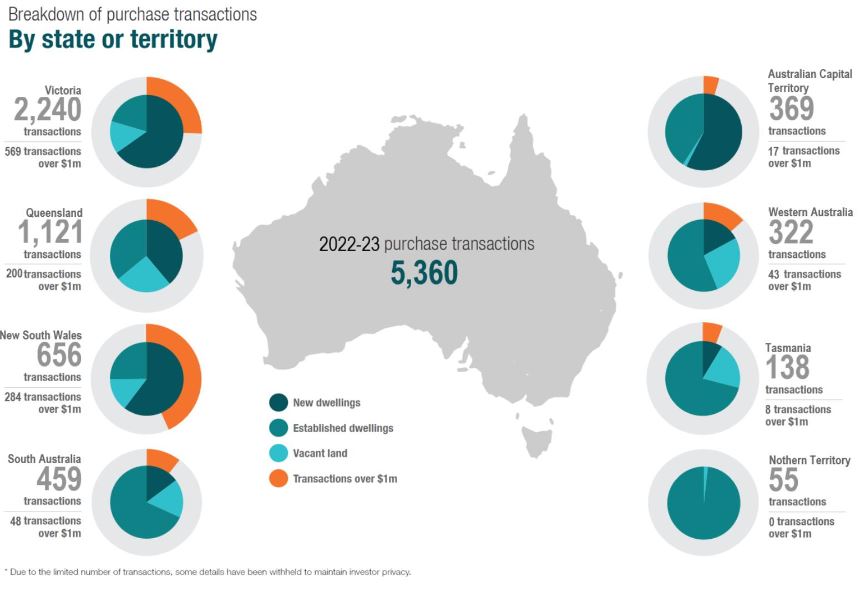

The Australian Taxation Office on Friday (21 June) released its Register of foreign ownership of residential land, which showed that Victoria had become the preferred choice of foreign investors.

Foreign buyers spent $4.9 billion on 5,360 Australian dwellings in the financial year to 30 June 2023 (the most recent data available), with Victorian investment leaping a massive 32 per cent over a year.

Foreign buyers paid an average price of $914,000, which is just below the overall average price across the country of $959,300 in the March quarter, according to the Australian Bureau of Statistics.

The data also showed that buyers were expressing a degree of confidence in the Australian property market, with buyers far outstripping sellers.

They sold 1,119 homes, with a total value of $1.0 billion. It is noteworthy that the definition of sale also includes when a foreign buyer becomes a permanent resident or citizen, even if they don't actually sell the property, so the actual sales number is inflated against the buyer figure.

The number of offshore buyers in New South Wales was flat, and actually decreased by 1 per cent, from 664 to 656. Meanwhile, the number of buyers in Queensland and Victoria jumped. The number of buyers in Queensland climbed 17 per cent, while the number of buyers in Victoria jumped 32 per cent, by about a third.

While Queensland attracted more buyers over all, New South Wales attracted more millionaire buyers. Foreign buyers purchased 284 homes in New South Wales during the year that were worth at least $1 million, compared to only 200 in Queensland.

"Victoria got by far the most millionaire buyers, with 569 foreign buyer transactions worth over $1 million each.

Overseas buyers not super wealthy

A widely held perception that foreign buyers are wealthier than local buyers was dispelled by the data.

Residential properties with values under $1 million formed the majority of residential property purchase transactions, accounting for 78.2 per cent of property transactions in 2022-23. This is an increase compared to 75.4 per cent in 2021-22.

Nor did this investment lead to any significant population growth. Of the 5,360 purchase transactions in 2022–23, 164 registrants became a permanent resident or gained Australian citizenship during the year (and are included in these statistics).

Daniel Ho, Juwai IQI Co-Founder and Group Managing Director, said the 27 per cent increase in buying last year shows that overseas buyers were bouncing back after the travel slowdown during the pandemic.

“Why do foreign buyers like Australia?

“This report, encompasses buyers from all over the world, including all parts of Asia, North America, South Africa, and the UK and Europe, and such a wide population has varying motivations, but they all have some things in common - they appreciate Australia’s strong economy, good education system, and attractive lifestyle.”

He added that these foreign buyers contributed to the government’s coffers.

“In many cases, these buyers paid 7 per cent or 8 per cent of the purchase price on stamp duty and tens of thousands of dollars, or more, on foreign buyer application fees (compared to local buyers) and once they own their property, at least until they become permanent residents or citizens, they will pay an additional land tax every year.”

Mr Ho said Australia’s apparent popularity was actually reflective of a wider international trend.

"People have been moving to Australia in record numbers, and that shows up in the foreign buyer reports but it's not just Australia, because we see the same thing happening in the US, Canada, Europe, and the UK.

“There is a significant wave of post-Covid migration as people act on plans they had to put on hold during the pandemic.

“We also see it in Southeast Asian countries like Thailand, which have seen rapid intake of their golden visa programs since the pandemic.

“If the Australian government succeeds in reducing the number of foreign students and other migrants coming to the country, we can expect foreign buying to be affected.”

There are signs that foreign buyers are expanding their search beyond the east coast of Australia.

Victoria, New South Wales and Queensland still represent 86.9 per cent of all sale transactions, making up 91.3 per cent of the value of sale transactions for the reporting period.

But this is down markedly from 2021–22, when Victoria, New South Wales and Queensland represented 97.0 per cent of all sale transactions and 97.8 per cent of the value.

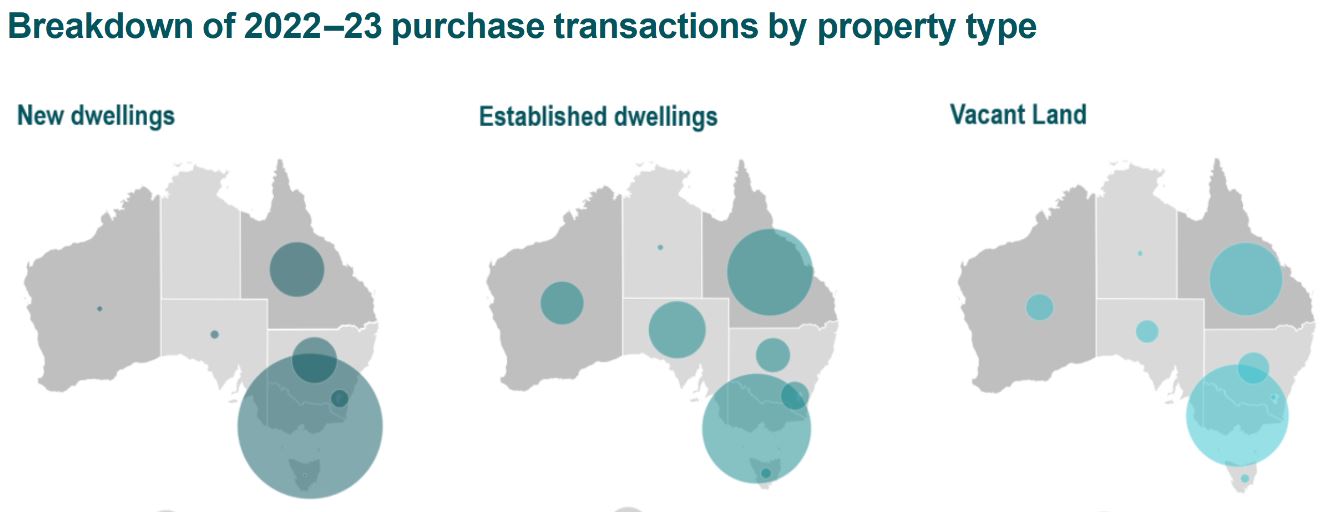

Tracking purchases over five years shows that South Australia features among the top three states, along with Victoria and Queensland, when it comes to transactions on vacant land.

Foreign buyers still a small pool

Foreign buyers comprise just 1.1 per cent of residential property sales across Australia.

Terry Ryder, Managing Director, Hotspotting, told API Magazine, that the latest number actually underlined just how little foreign investment there is in Australian residential real estate.

“There may have been a 27 per cent annual rise in transactions, but that’s from a really low base.

“Foreign buyers have been slugged in major increases in taxes in recent years, a trend that continued with the latest Federal Budget and some of the state budgets.

“It's resulted in fewer foreign investors compared to historical norms and that has impacted the supply of apartments.

“Foreign buyers were once a major source of off-the-plan sales that allowed high-rise developers to get sufficient pre-sales to secure finance and proceed with a major project.

“Using foreign buyers as a cash cow with no electoral consequences is very short-sighted and has contributed to the rental shortage and the overall undersupply of new dwellings.”