Bank of Mum and Dad – how much help is too much?

Parental support for children trying to get a foot on the property ladder is gaining more traction every year but both parties need to be aware of the risks and rewards.

Recently the Bank of Mum and Dad was ranked the biggest player in the Australian property market.

According to Housing Monitor Research, 40 per cent of parents in 2024 aided their first home buyer kids with housing contributions.

The reality is that parental support has been around for a long time, but it’s changed recently.

From pre-nuptial agreements to gifted deposits, the landscape is changing. Legal considerations are also a point of contention for some beneficiaries. Navigating the property ladder with parental support isn’t what it used to be.

I interact with the fortunate offspring and doting parents on a regular basis. I’m often asked, “How can I help my kids get into the property market?” I have witnessed all types of assistance, and some work better than others.

Let’s start with the parents who wish to gift their children a home.

It starts from an early age; in fact, some parents dream about what they’ll gift their children before they’re even born, and plenty of parents start mapping out their property investment journey when the children are pre-schoolers.

But for most parents who consider what their post-school children’s housing needs could be, their generosity usually kicks in during the high school years.

Things get exciting when the children actually want to pursue home ownership. Kids can ask their parents in all kinds of ways to assist, and parents aren’t always in a financial position to help.

Various ways parents help children into home ownership

Assistance can range from outright gifting of a home to gifting of a deposit. Some assist with a contribution towards a deposit, while others may come up with a tailored loan arrangement.

And then there is the guarantor option.

Lenders cater well to the parental third party guarantor arrangement, whereby parents with available equity in their property lend a helping hand by releasing that equity to their child(ren).

The way that this technically operates has a lot of nervous parents flummoxed, and for good reason. Parents who have scrimped and saved to secure their home will be particularly nervous about risking that asset.

It’s more than just a financial product; it’s their security and the very roof over their head.

The thought of a loan arrangement going bad sends a shiver up their spine and has them fearing a mortgagee sale and homelessness.

The interesting thing about parental equity guarantees and associated risk is all about the percentage of the loan that is at risk to the parent, and the fear that such an arrangement can embed within a nervous parent’s psyche.

Guarantor is no gift

The guarantor arrangement is not well understood by parents and children.

Marketers pitch this to recipients as a no deposit option.

Parents get the request over a BBQ lunch, or an awkward coffee and they are often torn between aiding their kids on this all-important voyage and protecting their most valuable asset.

They fear several things; from reckless property decisions to bad partner selection, (and everything in between).

After all, these are the parents who have witnessed bad teenage behaviours and terrible financial mistakes in the previous decade. It’s little wonder many of them feel their blood run cold when their children ask them to consider going into a binding legal and financial arrangement for a property purchase.

But what does it really mean? These days, ‘Family Pledge Loans’ or ‘Parental Loan Guarantees’ are highly detailed, legally regulated and particularly effective for those parents and children who can take up the opportunity.

For parents, the deal can be sweet because they aren’t ‘gifting’ funds to their child(ren), but they are enabling them to take use of the equity they have built up in their home. Equity is best described as “the value of mortgaged property after deduction of charges against it”, or in other words, the amount that remains when the debt is subtracted.

Banks will generally allow an eligible borrower to access up to eighty per cent of the value of their home, and in many cases, parents have this amount available due to the combination of debt repayments and capital growth.

The part many assume wrongly is that their entire equity position is at risk when supporting a child.

In fact, lenders broadly rely on up to 25 per cent of a parent’s home for this equity. It represents the deposit and the stamp duty for the purchase of a home. In many cases, children have already amassed savings to cover a portion of the deposit obligation, so sometimes the parent’s equity obligation is even lower. The equity loan is just that, a loan. Children can access it, but they must pay for it.

Furthermore, most lenders require a lawyer to oversee and explain the documentation to the parent before they embark on the loan arrangement.

Mortgage arrears and risk

Importantly, the lender is clear about the risks that the guarantor takes on in the event of mortgage default (i.e. mortgagee not making their loan repayments).

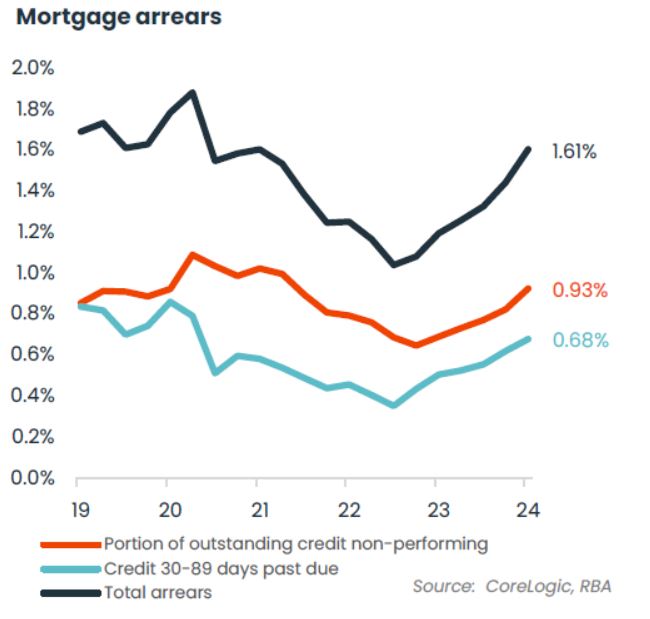

The parental loan component is restricted to the percentage that they offer up in equity, being a limited amount, and not the full debt obligation. The security property (i.e. their children’s property) would be sold first in the event of mortgage default, not their property. As alarming as this sounds, Australian mortgage arrears are currently sitting below 1 per cent.

The young recipients are usually determined to pay down the debt and release their parent’s property at their earliest convenience. It is usually evident that they truly treat the parents’ contribution as a privilege rather than an expectation, and most are vitally aware of their parent’s sense of concern.

Thanks to rising house prices, many are able to release their parent’s security in a matter of two or three years as rising asset prices carry the loan to value ratio (LVR) above the required 80 per cent very quickly.

The parents who assist in non-direct financial ways are often those who spot the government incentive opportunities; and there are plenty of these in our various states/territories and national offerings.

Parental guidance recommended

Then there are the parents who help with the strategy, the inspections and the self-education. Sometimes these are the greatest gifts that parents can impart, because they teach their children how to ‘fish’.

From pocket money incentives for their young ones to moral support as their twenty-somethings embark on their home ownership adventure, they are the parents who are by their side, offering as much advice as they can muster.

But who gets it right? And can we adversely impact our best intentions with kindness?

Every child is different. Some need to run their own race and valiantly claim home ownership as their own. Others benefit greatly from a financial helping hand, particularly when we consider the negative impact of wasting time waiting for the right time to buy.

There are chose children who cherish the opportunity to have a deposit secured from parental equity, and I can relate to the prospective buyers who have mum and/or dad by their side, helping with the inspection checklist or backing them on auction day.

What we can’t underestimate is the power of self-achievement. Sometimes just cheering from the sidelines is the best gift we can give.

Recognising what our kids can achieve themselves, versus what is incomprehensible or unachievable for them is important. We can’t rob them of their own achievement, and nor should we. But if we can make that incredible difference at a time that is critical in life, why wouldn’t we?